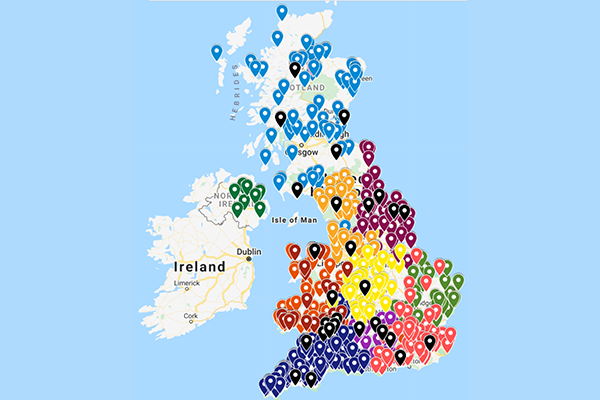

Stamp Duty Land Tax - UK Rates What are the Stamp Duty rates across the UK?

Stamp Duty rates for buying property in England & NI

| Property or lease premium or transfer value | SDLT rate |

| Up to £250,000 | Zero |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5million) | 10% |

| The remaining amount (the portion above £1.5million) | 12% |

Higher rates of Stamp Duty Land Tax

If you’re buying an additional residential property to the one you call home, including holiday lets, you will pay the higher rates of Stamp Duty Land Tax. This is known as Higher Rates on Additional Dwellings (HRAD).

Higher rates apply if:

- If the residential property you’re buying is worth £40,000 or more, and you already own a property worth £40,000 or more.

- On additional properties that you part own, so long as your share is worth £40,000 or more.

- If you own a property abroad and are looking to buy an additional property in the UK worth more than £40,000.

- If you’re married or in a civil partnership, the rules apply as if you are buying the property together, even if you’re not. So, if your spouse has to pay the higher rates, you’ll also have to pay them.

If you’re buying a property in Scotland, you’ll pay a tax called Land and Buildings Transaction Tax (LBTT) instead of Stamp Duty, and in Wales you’ll pay Land Transaction Tax (LTT).

Land and Building Transaction Tax (LBTT) - Scotland

In Scotland, you must pay Land and Buildings Transaction Tax (LBTT) when you buy a residential property worth more than £145,000 – this is done on a tiered basis, requiring payment per each part of the purchase price in each threshold.

Announced in the 2021-22 Scottish Budget, the Land and Building Transaction Tax rates are below:

| Purchase price | LBTT rate |

| Up to £145,000 | 0% |

| £145,001 to £250,000 | 2% |

| £250,001 to £325,000 | 5% |

| £325,001 to £750,000 | 10% |

| Over £750,000 | 12% |

The higher rates charged on additional dwellings is known in Scotland as the Additional Dwelling Supplement (ADS). As of 16 December 2022, the ADS rate is 6%.

Land Transaction Tax (LTT) - Wales

In Wales, when you buy a residential property worth £225,000 or more, you’ll have to pay Land Transaction Tax (LTT). Again, this is calculated on a tiered basis based on different property price bands.

The below rates apply for transactions with an effective date on or after 10 October 2022:

| Price threshold | LTT rate |

| The portion up to and including £225,000 | 0% |

| The portion over £225,000 up to an including £400,000 | 6% |

| The portion over £400,000 up to an including £750,000 | 7.5% |

| The portion over £750,000 up to an including £1,500,000 | 10% |

| The portion over £1,500,000 | 12% |

If you’re buying an additional residential property worth more than £40,000, you’ll also have to pay an extra 4% on top of the standard LTT.

Why Zeal?

Zeal are independent tax advisors and members of the Chartered Institute of Taxation (CIOT). We specialise in helping businesses claim this tax relief and could help you get your savings in as little as four weeks!

Unlike other firms, Zeal don’t just prepare a report detailing our findings, we do all the tax work, deal with HMRC on your behalf and offer an aftercare service to help you or your accountant apply your tax savings to future tax payments.