News

19th December 2025

Podcast: Budget Hits Holiday Let Owners | Matt Jeffery explains what’s changed

27th November 2025

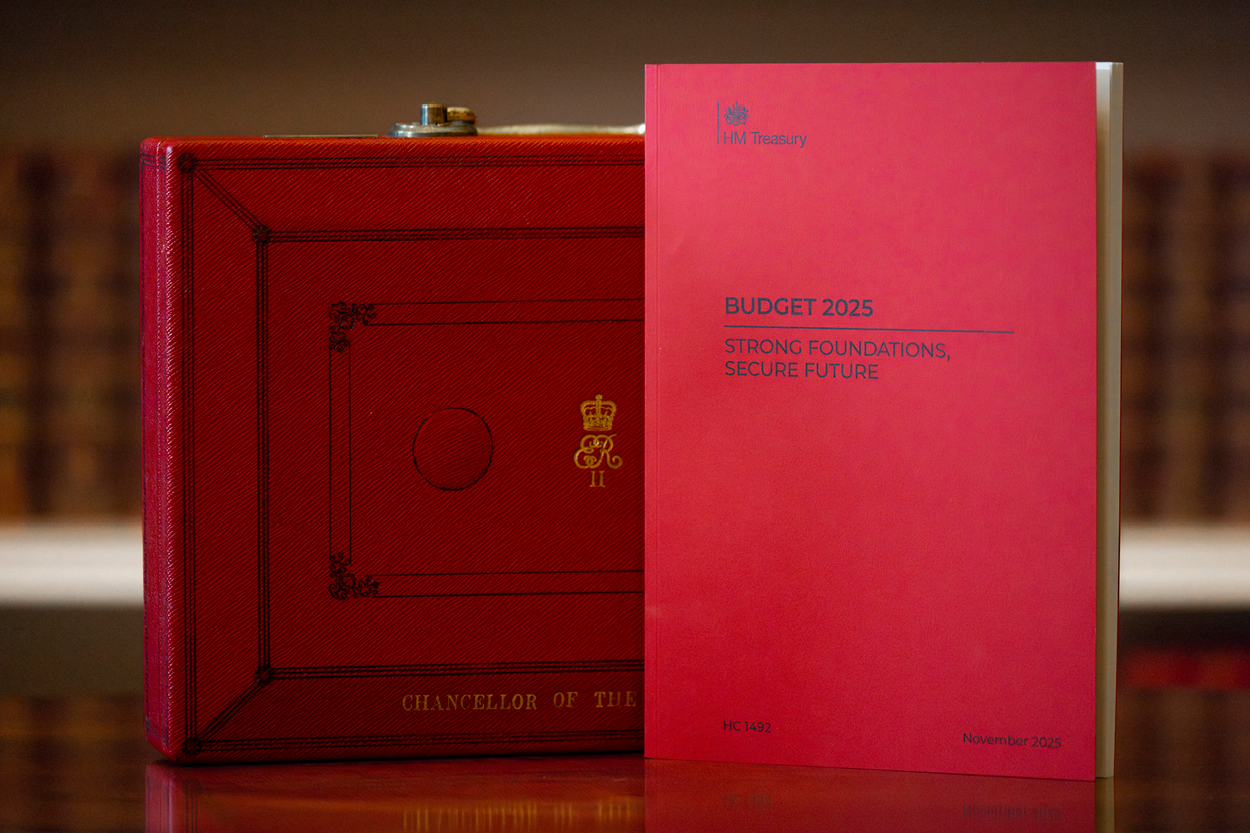

Article: Autumn Budget 2025 – What the changes mean for FHL Owners

23rd October 2025

Article: 3 Primary Tax Considerations now the FHL Tax Regime has ended

12th September 2025

Meet leading UK Holiday Let Tax specialist, Matt Jeffery, at an event near you!

15th August 2025

Podcast: Matt Jeffery explains How the End of FHL Tax Relief Affects Holiday Let Owners

10th June 2025