Holiday Let Tax Zone Zeal are Furnished Holiday Let Tax specialists!

Following the abolition of the Furnished Holiday Let (FHL) Tax Regime in April 2025, a lot of owners have been left wondering ‘What now?’, or even thinking ‘I’ve left it too late to act!’. Don’t panic!

As the trusted tax partner for several key industry leaders, including PASC UK (Professional Association of Self-Caterers), you’re in safe hands with Zeal!

What do the changes mean for owners?

From tax year 2025/26 (6th April 2025 to 5th April 2026) the FHL regime will be abolished for individuals, companies and Trusts that

operate a qualifying FHL business. This means that previous tax benefits will no longer be received (subject to transitional rules) and FHL’s will be taxed in the same way as long term residential or commercial lets.

In practice, this means the section of your tax return that was previously split into two sections (FHL section and UK Property section) will now be merged into one. Income and expenses from all UK properties will be accounted for together, and tax paid on the net profit of the combined lets. There will be no changes to how you calculate your profits.

Contrary to the wording, a ‘Furnished Holiday Let’ is not just a property just used for holidays. It covers all accommodation let furnished, on a short-term basis, including Serviced Accommodation (SA), AirBnbs, Self-Catering Lets and more.

The new rules will have the following key implications:

Interest on finance costs can no longer be deducted from income. A tax reducer limited to 20% of the interest costs will now be claimable.

Capital Gains Tax (CGT) reliefs have been withdrawn completely.

Profits from short-term letting are no longer classed as ‘relevant earnings’ for pension contributions.

Income from jointly held property must now be shared equally.

CAPITAL ALLOWANCES are no longer available. The last opportunity to make a capital allowances claim is in your 2024/25 tax return.

Get prepared! Watch Zeal's free on-demand webinar . . .

Find everything you need to know about the new Furnished Holiday Let (FHL) tax rules from April 2025 and actions to take now to ensure the longetivity of your business on Zeal’s on-demand webinar: The New Holiday Let Tax Landscape & What Owners Should Do Now.

Chartered Holiday Let Tax Specialist, Matt Jeffery, also advises on how to become as tax efficient as possible (including if incorporation is the solution for you) and how you can unlock thousands of pounds in missed tax savings sitting unclaimed your holiday let property, before it’s too late!

Zeal has also written an extensive 43-page eBook to help short-term let owners understand the full extent of the changes. To request a copy, email [email protected]

Chapters cover changes to Finance Cost Restrictions, Capital Allowances, Capital Gains Tax, Profit Allocation, Pension Contributions, Business Rates, VAT, Inheritance, Incorporation, and more.

The clock is ticking . . .

Claim your tax relief entitlement, before it’s too late!

Now that April has passed, short-term let owners will soon lose their ability to claim capital allowances.

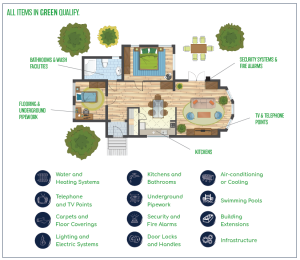

Whilst you may have heard of capital allowances already, you may not be aware of the ‘extra’ level of capital allowances that could be available to you which an accountant is NOT typically able to claim.

This extra tax relief can be claimed on part of the costs you incurred to purchase, build, convert or refurbish your property for the ’embedded’ fixtures within the fabric of the building.

Essentially, these are items that would not fall out if the building was turned upsidedown.

To identify and claim qualifying expenditure, quantity surveying skills and specialist capital allowances knowledge are required.

That’s where Zeal come in.

On average, Zeal identify 20%-30% of the original costs incurred to purchase, construct or refurbish a property in qualifying capital allowances. Even if you incurred expenditure or bought the property years ago, you could still make a claim now, but time is of the essence!

The last opportunity to make a capital allowances claim is in your 2024/25 tax return. Any cash and tax savings entitlement not claimed by the deadline will be lost forever.

Free, no obligation proposal

It costs nothing to find out if you’re missing out on tax savings. We’ll confirm if you meet the criteria and provide a no-obligation proposal outlining an estimate of your entitlement, all for free.

It's risk-free!

There are no upfront costs for our service! We operate on a success fee basis so you only pay if your claim is successful. Plus, Zeal are rated ‘Excellent’ on Trustpilot.

Qualified Experts

Zeal are Chartered Tax Advisors & RICS Quantity Surveyors have specialised in capital allowances for over two decades. We comply will all UK tax legislation and HMRC guidelines and have a 100% success rate on submitted claims.

Obtain thousands of pounds in tax savings to mitigate HMRC payments for years to come.

Receive a cash rebate from HMRC for tax you have unknowingly overpaid.

Use allowances generated to offset tax due on ANY UK property income (from 2025/2026 tax year).

Unlocked by Zeal for short-term let owners in 2025 (so far*)

Have you read Zeal's Guide to Capital Allowances?

You may also be interested in . . .

Zeal are the proud tax partners of:

Exclusive offering for our partners and their owners:

Zeal’s Tax Resource Hub

A collection of free tax material at their fingertips!

From tax articles, help sheets and videos, to guides and eBooks on everything from the Tax Changes for FHL owners (and how to mitigate the impact on your business), Making Tax Digital, Tax-Deductible Expenses, structuring FHL businesses tax efficiently, EPC tax implications, Capital Allowances (and how it isn’t too late to claim), plus more!