Thursday 20th March 2025

Following the abolition of the Furnished Holiday Let (FHL) tax regime, short-term lets will be taxed in the same way as long term lets. However, the expenses incurred on short-term let’s will be different to long lets.

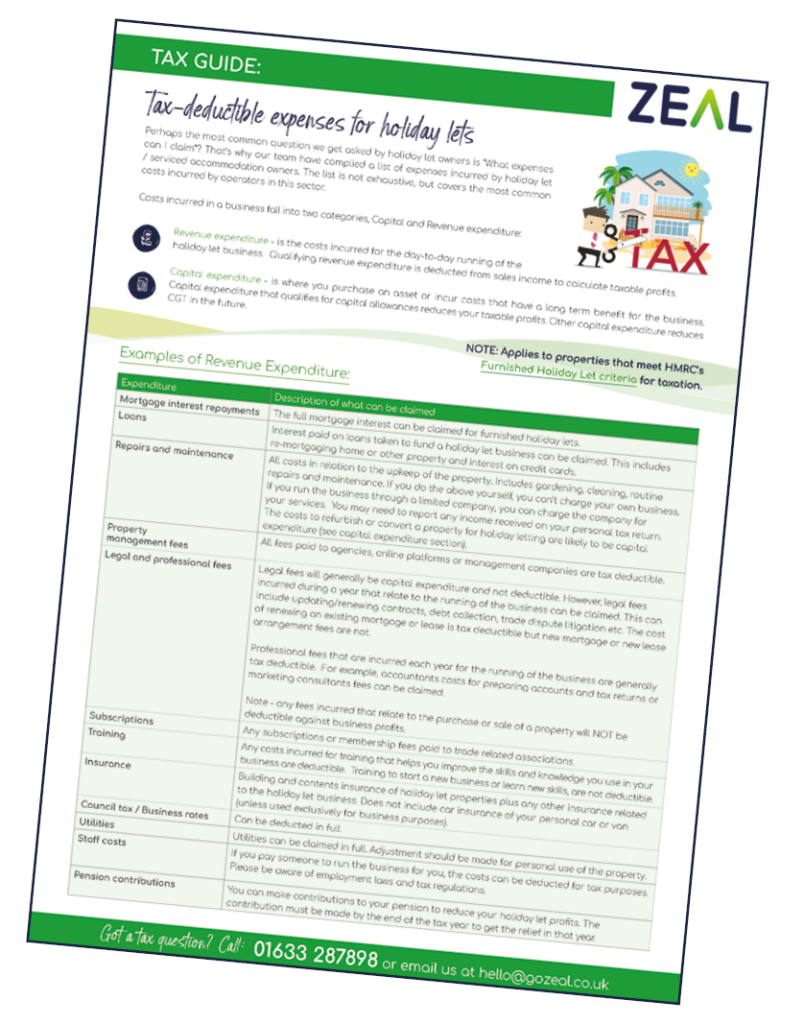

Costs incurred in a business fall into two categories, Capital and Revenue expenditure.

Revenue Expenditure – is the costs incurred for the day-to-day running of the holiday let business. Qualifying revenue expenditure is deducted from rental income.

Capital Expenditure – is where you purchase an asset or incur costs that have a long-term benefit for the

business. Capital expenditure no longer qualifies for capital allowances to reduce your taxable profits.

Capital expenditure reduces your Capital Gains Tax (CGT) in the future.

Zeal have compiled a list of expenses incurred by short-term let owners and how they are treated for tax purposes. The list is not exhaustive, but covers the most common costs incurred by operators in this sector.

Download Zeal’s Tax Guide below!

Need help with Tax-Deductible expenses pre-April 2025?

We have a tax guide for that too!