Capital Allowances Zeal can shine a light onunclaimed tax savingsin your business property

The best kept secret in property tax

What are Capital Allowances?

Capital allowances are a form of tax relief that allows qualifying capital expenditure to be offset against taxable profits. Whilst many businesses and commercial property owners have heard of capital allowances, most simply assume “my accountant already claims capital allowances for me”. . . This is not typically true!

Whilst accountants are able to claim some capital allowances, it’s usually restricted to items like furniture and equipment that are purchased and have a receipt.

What around 80% of owners and investors don’t realise is that capital allowances extend to the ’embedded’ fixtures in their commercial property!

This extra level of capital allowances can be claimed on part of the costs you incurred to purchase, build, convert or refurbish your property. As a complex area of UK tax legislation, a combination of quantity surveying expertise and specialist capital allowances knowledge is required to identify and claim qualifying expenditure. It is therefore not a tax relief an accountant can typically claim.

Capital Allowances on ’embedded’ fixtures

Capital allowances can be claimed on the embedded fixtures and fittings that were already in the fabric of the property at the time of purchase. Essentially, these are items that would not fall out if the building was turned upsidedown.

On average, Zeal identify between 20%-30% of the original costs incurred to purchase, construct or refurbish a property in qualifying expenditure. This generates thousands of pounds in tax savings which can be used to mitigate future HMRC payments for years to come. In most cases, owners also receive a cash rebate from HMRC for tax they have unknowingly overpaid.

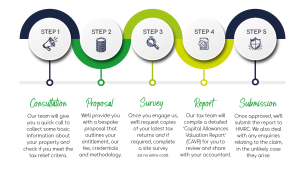

Claiming Capital Allowances with Zeal

Free capital allowances review & no-obligation proposal

It costs nothing to find out if you are missing out on tax savings. Our team will ask you a few questions to confirm you meet the qualifying criteria, and provide a no-obligation proposal outlining an estimate of your entitlement, our cost, credentials and methodology – all for free.

Qualified & experienced experts

There are many firms who claim to be capital allowances ‘specialists’ yet don’t actually consist of any qualified tax advisors! Zeal on the other hand are CIOT (Chartered Institute of Taxation) accredited. Our technical team consists of Chartered Tax Advisors and RICS Quantity Surveyors who have specialised in capital allowances and other property tax related matters for over two decades. You’re in safe hands with Zeal!

A complete capital allowances service (and aftercare!)

Unlike many other firms who just prepare a Valuation Report (CAVR), Zeal are unique in our ability to provide a full capital allowances service. Our in-house specialists do all the tax calculations (including amending relevant tax returns), submit the claim to HMRC, deal with any queries in the unlikely event they arise AND provide professional aftercare at no extra cost to offer clients and their accountant any support needed to apply future tax savings.

Risk free, fully compliant guarantee

Not only is our process is fully compliant with tax legislation, Zeal have developed a blueprint methodology that has been pre-agreed with HMRC and the Valuations Office Agency to ensure claims are agreed quickly and easily. Plus, as Zeal operate on a success fee basis with NO fixed or upfront fees, you only pay a fee if your claim is successful! Our fee is based on a percentage of the allowances we find and agree with HMRC. We also offer a free survey to identify and value all qualifying items. Some other firms charge £1,000+ for the survey alone.

Rated ‘Excellent’ with 100% success

We’re really good at what we do, and we’re not just saying that! Zeal have a great track record. Our ‘Excellent’ rating on Trustpilot is testament to this. Plus, 100% of our submitted claims to date have been approved by HMRC – resulting in very happy clients!

![]()

Accountants are our friends!

Many of our clients have close relationships with their accountants or other trusted advisers. We are not accountants and aren’t here to step on any toes! Much like a GP would work with a medical specialist such as a cardiologist (if they suspected their patient had a heart condition), accountants and tax specialists often also work together to get the best outcome for their clients. We’re used to working collaboratively with clients’ advisors.

You may also be interested in . . .

Zeal have identified millions of pounds in missed claims for tax relief to date - and can do the same for you!

Reduce your tax bill – or maybe wipe it out altogether

Get cash back - for tax you didn’t know you had overpaid

Unlock thousands of pounds in future tax savings

Your accountant will not have claimed without using a specialist like ourselves

Capital Allowances Tax Relief for. . .

Looking for advice for your client?

Zeal partner with other professionals!

Some areas of our business are complex. We explain those complexities on our frequently asked questions page. We even try to explain unavoidable industry jargon. Our regular blogs also provide context to help explain the fundamentals of our work.

If you still can’t find what you’re looking for, please feel free to get in touch. We’d love to hear from you. We’re always happy to chat about your business to help you think differently about tax savings.

For new generation tax advice Do it with Zeal.

Book a call