Author: Matthew Jeffery, Tax Director

In this article, Zeal explains about VAT implications for Furnished Holiday Let owners.

What is Value Added Tax (VAT)?

Value Added Tax is a tax applied to the price of certain goods and services that are bought and sold in the UK.

Most goods and services are subject to standard rate VAT of 20%, while some, such as domestic utilities and child car seats are subject to a VAT rate of 5%, and most food and children’s clothing is subject to a 0% VAT rate.

Some items such as insurance are exempt from VAT, so no VAT applies to these goods or services.

Income from Holiday Lets – Is this Subject to VAT?

Income from self-catering holiday accommodation is within the scope of VAT. This includes all accommodation advertised or held out as suitable for holiday or leisure use and includes houses, flats, caravans, houseboats, lodges, chalets and even tents. So, if the gross income from your holiday let exceeds the VAT threshold, it is compulsory to register for VAT. The income is classed as standard rated (20%) for VAT purposes.

When do I need to register for VAT?

From the 1st of April 2024, the VAT threshold is £90,000 (increased from £85,000). It is extremely important to note that the threshold is measured on a rolling 12-month basis rather than a fixed period, like a calendar or tax year.

The threshold relates to and encompasses all relevant business activities carried out by an individual taxpayer (employment and other investment income do count in this circumstance).

If you exceed the threshold or expect to within the next 30 days, it is important to notify HMRC immediately. It is recommended that you speak with a tax specialist who has experience in this area.

Can I Voluntary Register for VAT?

You can register for VAT without reaching the VAT threshold. You should consider voluntary registration if your customers will be VAT registered (uncommon in the holiday let industry) or you have incurred VAT on set-up or refurbishment costs and expect to be VAT registered soon after you start letting.

How do I register for VAT?

Registration is quite a straightforward process and can be completed online via the HMRC website. HMRC will then issue a VAT Registration Certificate. Once registered, HMRC will confirm the date that VAT should be charged from and the dates you will need to submit your VAT returns.

What is the Flat Rate Scheme for VAT?

Under the standard VAT scheme, a business usually pays HMRC the difference between the VAT charged on turnover and the amount recovered on expenditure. For example, the VAT on commission charged by Sykes can be deducted from the VAT due on your rental income.

The Flat Rate Scheme is much simpler and uses a fixed percentage of your turnover and you are unable to reclaim VAT on your purchases except for capital expenditure exceeding £2,000. The £2,000 is based on the invoice total. So, if you buy several items of furniture from the same supplier for £2,000 or more, the whole VAT cost can be reclaimed.

The flat rate for accommodation is 10.5% and as bonus you receive a 1% discount on the first year of your registration.

If, however, the goods you buy for your Furnished Holiday Let (FHL) cost less than either 2% of your turnover or £1,000 in any one year then you will be classed as a limited-cost business. If this happens the flat rate will be 16.5%. The cost of gas and electric can be included here.

If you believe that your turnover will be less than £150,000 in the next 12 months, then it is possible to register for the Flat Rate Scheme during the online HMRC online VAT registration process. The turnover figure is the figure excluding the VAT element, so a gross turnover (including the VAT) of £167,598 (assuming the 10.5% flat rate is the upper limit). The Flat Rate Scheme can not be used if turnover is expected to exceed £230,00 in the coming 12 months.

Additional Income Required to Compensate for VAT.

The marketed rental price will need to absorb the impact of the VAT, so assuming VAT at the standard rate of 20% is applicable, then this will drop the income you receive by one sixth, which is 20% divided by 120%.

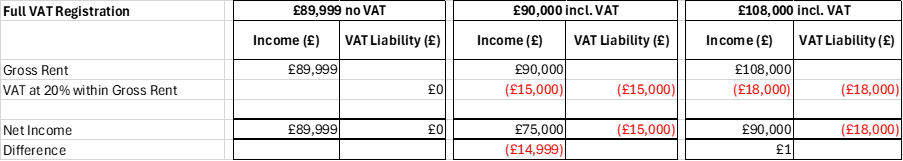

Examples to demonstrate this are set out below, based on a VAT registration limit of £90,000 in any 12 month rolling period.

The above example shows that Gross Rent (turnover) would need to increase by 20% to absorb the impact of registering for VAT on the standard scheme. That is turnover (Gross Rent) needs to increase from £90,000 to £108,000.

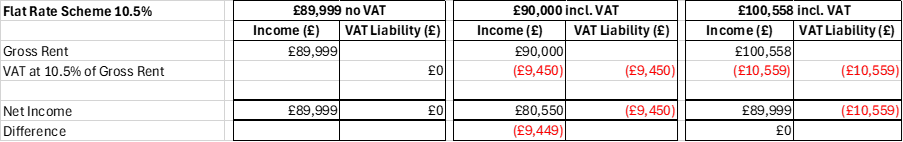

Under the Flat Rate Scheme, the additional income required to cover the VAT is lower at 11.7%, see below.

Increase required is £100,558 minus £90,000 equals £10,559 which as an increase on £90,000 is 11.7%.

Reclaim of Expenses Under Standard VAT Registration

If you have a standard VAT registration, then the VAT incurred on the purchase of goods and services for the holiday let can normally be reclaimed.

When you register for VAT, you can reclaim VAT paid on goods that you purchased in the 4 years before the date of registration and still own at that date. You can also reclaim VAT paid on services within the 6 months before registration. Where the goods and services are purchased both for private and holiday let use, then the proportion of the expenses used for the holiday let can usually only be reclaimed.

Further guidance available on HMRC website or through your own accountant / adviser.

Can I reclaim VAT on Refurbishment or Building Costs?

You can only reclaim VAT paid on refurbishment or building costs if you are VAT registered.

You need to be aware of the Capital Goods Scheme (CGS) if your project costs more than £250,000. If you don’t use the assets for a qualifying purpose for up to 10 years after, you will have to repay part of VAT reclaimed.

Submitting Your Vat Return and Record Keeping

HMRC include FHLs under their Making Tax Digital service which means that to submit a VAT return you will need to use suitable software and submit returns via your HMRC portal having created a VAT online account. If you owe HMRC money you will need to pay this over to HMRC by the date indicated when you submitted your return. There are several ways that are set out on the HMRC website to pay your VAT.

You must keep digital records of your VAT transactions; this is a computerised version of the data. This must include the date and time of the transaction, the value of the transaction and the rate(s) of VAT charged.

Any invoices or receipts related to your VAT records should be retained in their original format, which can be electronic or paper, and the records must be kept for at least six years.

Multiple Properties?

It is not possible to artificially split out your FHL business to avoid the VAT registration threshold. For example, using different limited companies to run each holiday let.

HMRC sees disaggregation as tax avoidance and has set rules to ensure that only legitimate ‘business splitting’ occurs.

It is recommended that you speak with a tax specialist who has experience in this area.

De-Registering for VAT

Once your turnover falls below £88,000 (the deregistration threshold), you can apply to cancel your VAT registration. You will also need to satisfy HMRC why you would not expect your turnover to exceed the registration threshold in the next 12 months.

There may also be clawbacks of VAT claimed when you de-register.

It is recommended that you speak with a tax specialist who has experience in this area.

Managing Availability

It is allowable to manage availability to ensure that the VAT threshold is not exceed but, in this case, please ensure you do not reduce availability to such an extent that you fail to qualify for business rates (small business rates relief).

What if I let it Long-Term in the Off Season?

If you let your holiday accommodation during the off-season for more than 28 days, the income would be exempt from VAT provided you can satisfy HMRC that there was a requirement to let long term due to seasonal trade in the area.

HMRC’s view is that ‘the holiday season normally lasts from Easter to the end of September, although some areas, such as London and Edinburgh, receive substantial numbers of visitors and tourists at all times throughout the year and are therefore not regarded as having a seasonal holiday trade’.

What if I have exceeded the VAT Threshold and Haven’t Registered?

It is recommended you make a full disclosure to HMRC as soon as possible if you have gone over the threshold and not registered. This will minimise exposure to penalties. Reclaiming VAT on goods and services before registration will also help mitigate the impact of any VAT due.

What if I only exceeding the threshold temporarily?

If you went over or are likely to go over the threshold temporarily, you may be able to write to HMRC to obtain a VAT registration exception. In this case, please contact HMRC for further advice.

Non-Resident Landlords

If you have a holiday let in the UK and are not UK resident for tax purposes, you will need to register for VAT regardless of your turnover if you actively manage and operate the holiday let business from overseas.

If you have a managing agent in the UK and are not actively involved in the day to day operation of the business, you will only need to register once you exceed the registration threshold.

It is recommended that you speak with a tax specialist who has experience in this area.

What Happens When I Sell?

If you are VAT registered and sell the property as a holiday let, this will class as a Transfer of a Going Concern (TOGC). Where the sale meets the conditions for TOGC, the supply is outside the scope of VAT and therefore VAT is not chargeable.

Need advice? Get in touch with Zeal!

01633 287898 | hello@gozeal.co.uk

Disclaimer by Zeal

This article was written by Matt Jeffery of Zeal Tax, a leading capital allowances specialist firm in the UK, as an educational piece to help business owners understand their VAT responsibility. Matt can be contacted either by calling 01633 287898 or by email on hello@gozeal.co.uk.

The information provided in this article is of a general nature. It is not a substitute for specific advice in your own circumstances. You are recommended to obtain specific advice from a professional before you take any action or refrain from action. Whilst we endeavour to use reasonable efforts to furnish accurate, complete, reliable, error free and up-to-date information, we do not warrant that it is such. We and our associates disclaim all warranties.