Stamp Duty Land Tax Refund Are you owed money foroverpaying Stamp Dutyon your property?

Do you have a Stamp Duty claim?

If you have purchased a property in the last 4 years, there are occasions where Stamp Duty Land Tax (SDLT) or equivalent will have been overpaid. This may include the purchase of a residence with multiple outbuildings or grazing land, a residential, commercial or mixed use investment property or perhaps transferred property to a limited company, family or pension funds.

If so, then it is likely that you could be owed money from HMRC for overpaying SDLT.

Property conveyancers and solicitors are unable to provide tax advice on transactions and often overlook opportunities to reduce or eliminate SDLT on property purchases. SDLT is a complicated area of legislation that contains over 40 different available tax reliefs. Conveyancers and even accountants are not aware of, or fully consider, the statutory reliefs available. Too much reliance is placed on HMRC’s tax calculator, which is overly simplified and doesn’t consider all relief’s that may be claimed.

What is Stamp Duty Land Tax (SDLT)?

Whether you’re purchasing a residential or commercial property, or even just buying a plot of land, you will be required to pay Stamp Duty Land Tax. It is a self-assessed tax calculated by you or by a property advisor like a conveyancer, when you buy a property.

This land tax is applicable throughout all of the UK, but depending on where you are located, you may know it by a different name and be subject to a different rate:

| England & Northern Ireland Stamp Duty Land Tax (SDLT) |

Wales Land Transaction Tax (LLT) |

Scotland Land and Buildings Transaction Tax (LBTT) |

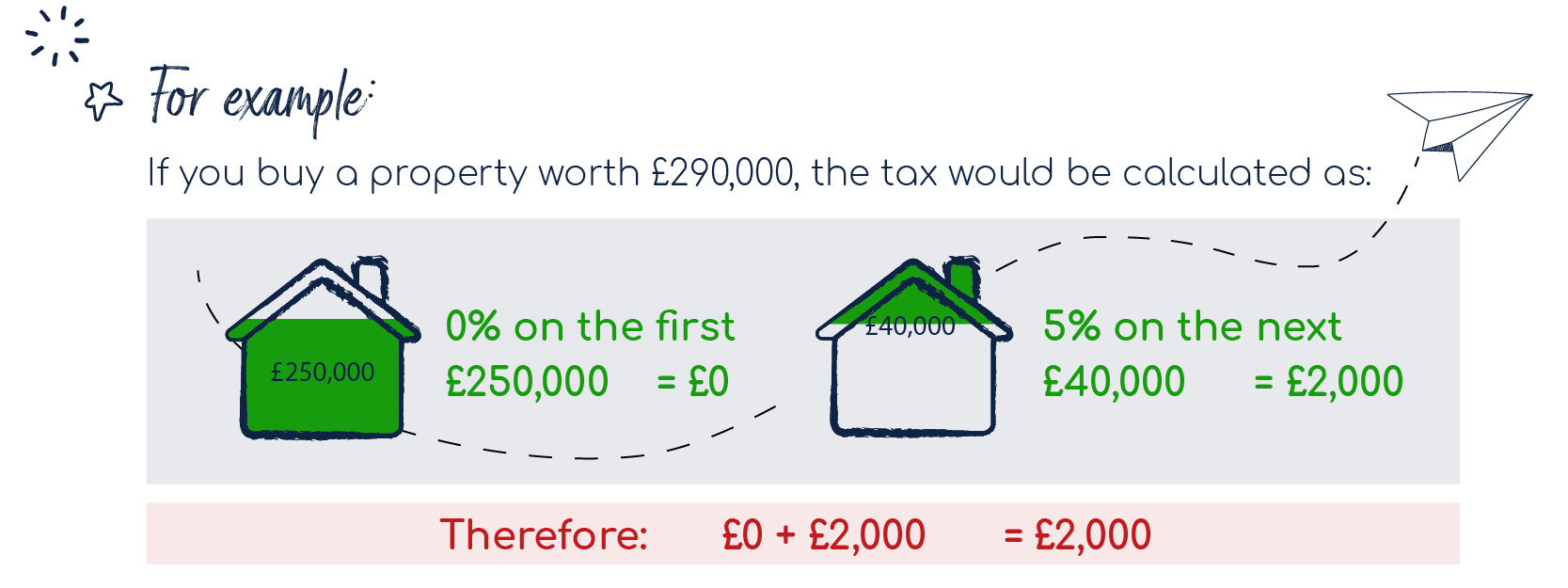

Illustrative Example – England and Northern Ireland

Stamp Duty Land Tax (SDLT) is payable if you buy a property or piece of land that costs more than £250,000. SDLT is calculated on a tiered basis – and you are taxed on the part of the property purchase price that falls into each Stamp Duty threshold.

Buying a property, need our help?

Zeal provide SDLT advice when acquiring property. By paying the correct amount of SDLT at the point of sale, the overall cost of acquiring the property is reduced, and vital cashflow is increased.

Zeal provide a free consultation to consider the SDLT implications of a property acquisition.

If there is an opportunity to reduce SDLT, Zeal will provide a report to your solicitor, which sets out the technical basis for any reliefs claimed. Our team will work alongside your conveyancer to complete the SDLT return and claim the relevant relief.

Are there any exemptions?

Not all purchases attract Stamp Duty. The rules on when you have to pay Stamp Duty and how much you must pay are extremely complicated. Generally, the following factors will affect whether you must pay and how much:

Why you bought the land/property and how much you paid.

Whether the land/property is used for residential or non-residential purposes.

Where you live i.e. if you are a UK resident or non-resident.

Whether you have bought anything else in a related transaction.

What reliefs are there?

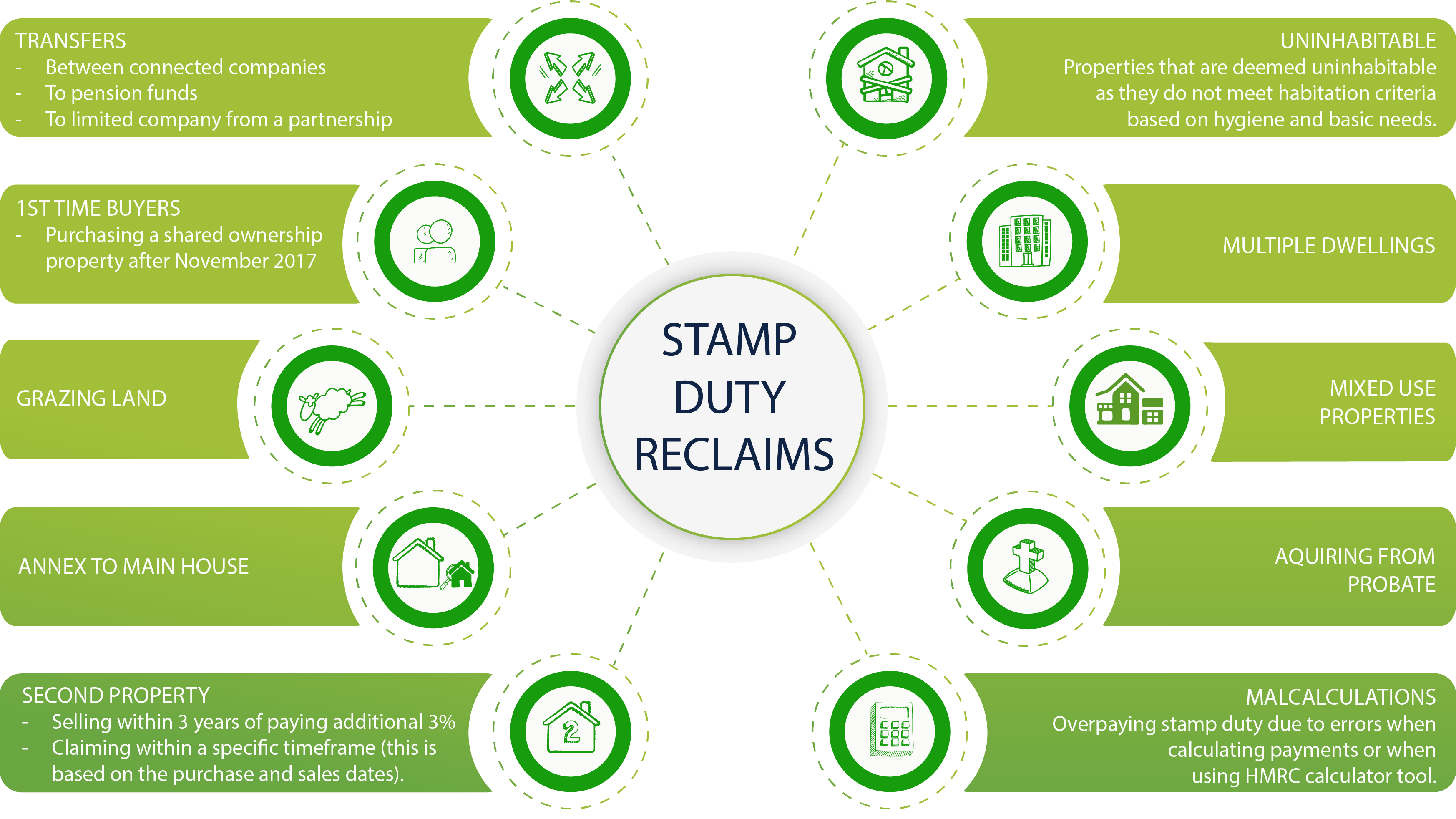

Please note that eligibility criteria may vary depending on the specific circumstances of your property transaction, but if you find yourself in one of the situations below, then you could potentially make a Stamp Duty Land Tax reclaim and should seek advice.

We love saving our clients tax!

Our team will review your eligibility to claim for free, and if we consider you have overpaid Stamp Duty, we can seek to recover any amounts on a success fee basis, meaning there are no upfront or fixed costs.

As we do all the groundwork up front, our professional approach to each case means we will only take cases forward that we consider have a strong chance of success.

Our tax advisers are CTA qualified with many years of experience. We take care of the whole process and also deal with any queries from HMRC. You can rest assured that you’re in safe hands with Zeal.

Our 5 step process is quick and simple. We do all the hard work for you and usually complete claims in as little as 4-6 weeks!

Read more

Some of the tax advice we provide is complex. We explain those complexities on our frequently asked questions page. We even try to explain unavoidable industry jargon. Our regular blogs also provide context to help explain the fundamentals of our work.

If you still can’t find what you’re looking for, please feel free to get in touch. We’d love to hear from you. We’re always happy to chat about your business to help you think differently about tax savings.

Our energy and enthusiasm is seriously infectious. For new generation tax advice Do it with Zeal.

Book a call