Author: Adam Spriggs, R&D Tax Director

What’s with all the percentages?

If you’ve ever seen marketing material relating to R&D Tax Relief then you’ve no doubt seen references to 230%, 33.35%, 13%, 24.7%, 14.5% or 10.53%. Some may explain at a high level what they mean or how they’re calculated but you may still be thinking what does it all mean.

Which of these percentages are relevant to you depends on which scheme you are claiming under; either the SME (less than 500 employees and either less than €100m turnover or €86m assets) or the Large Company scheme (not meeting the SME definition or in receipt of a grant or other subsidy

Choose an option below to see more information about the scheme best suited to your company size.

SMEs

In calculating a R&D claim, a company is uplifting expenditure within the P&L already in the accounts and claiming the uplift within the tax computation – an uplift of 130%. Therefore 230% relates to the total enhanced expenditure (100% already claimed plus 130% uplift).

Profit

If a company is still in a profit position after deducting the uplift it has reduced its Corporation Tax (CT) liability. The effective benefit of the claim is therefore 130% (uplift) x 19% (CT rate) = 24.7%.

Loss

If a company is in a loss position after deducting the uplift then there is no CT saving, however a company can surrender its loss for a tax credit at 14.5%. This mechanism is especially helpful to start-ups get something back in those early loss making years.

This is where most PR around R&D tax relief centres around – the magical 33.35%.

A company can surrender the lower of their available trade losses or their 230% enhanced expenditure. Therefore the maximum benefit a company could receive is 230% (enhanced expenditure) x 14.5% (cash credit rate) = 33.35%

Profit and Loss?

Not all R&D claims fall neatly either of the above categories, and for a lot their benefit may be a mixture of the two.

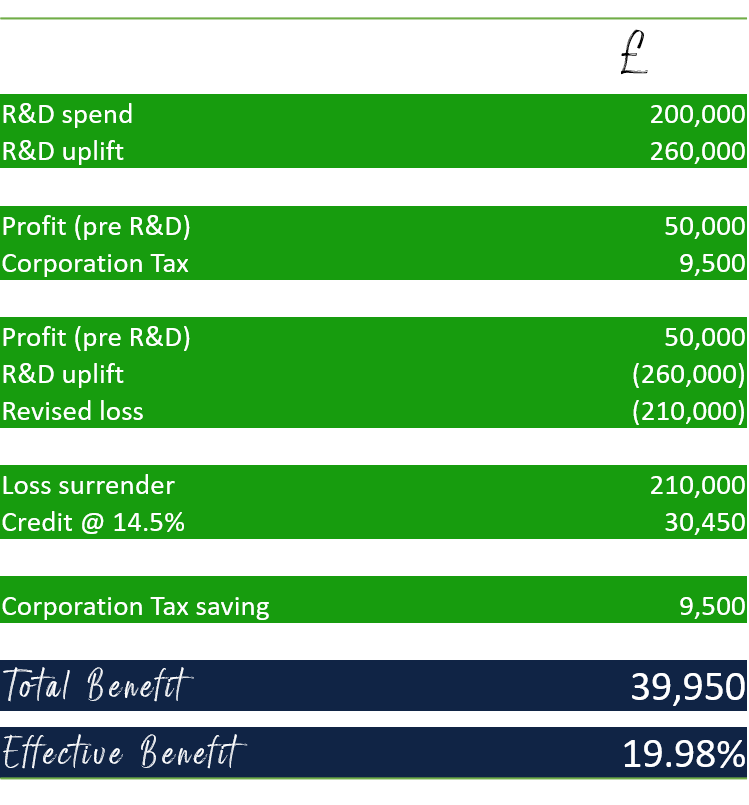

Example: ABC Ltd have taxable profits before an R&D claim of £50,000 and looking to make a R&D claim for £200,000. They have already paid £9,500 CT.

The uplift on £200,000 is £260,000 (at 130%), giving ABC Ltd a revised taxable loss of £210,000. On the assumption there are no group profits or CT in the prior year to offset this loss against, this loss can be surrendered at 14.5%, generating a cash credit of £30,450.

The total benefit to ABC Ltd is £9,500 (CT refund) + £30,450 (cash credit) = £39,950. This equates to a net benefit of 19.98%, which is a percentage that isn’t often reference.

The reason for this is that calculating the net benefit is straight forward if a company is heavily profit or loss making, but for any company that straddles being profitable and loss making their benefit can range from 18.85% (130% uplift x 14.5% credit) up to 33.35%. It’s therefore important for businesses to consider this when estimating their R&D Tax benefit and why it’s so vital to check a company’s tax position before advising on net return.

RDEC

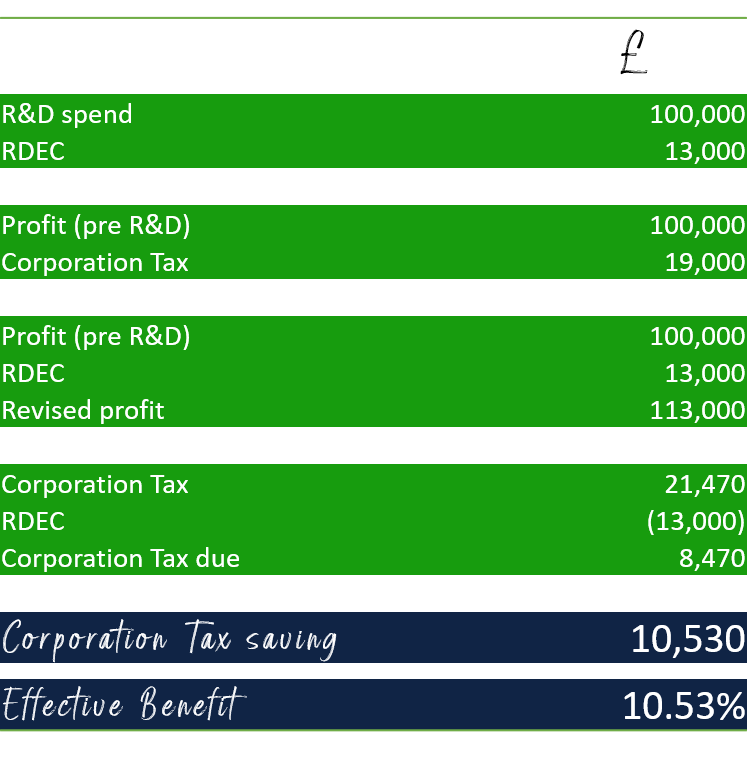

The Large Company scheme is called R&D Expenditure Credit (RDEC).The mechanism of the RDEC scheme is in some ways more straight forward and in others more complicated.

Since April 2020 the RDEC rate is 13% (12% before this), and after calculating a company’s qualifying expenditure in much the same way as SMEs (with the exclusion of nearly all subcontractors), a company’s taxable P&L is increased by 13%.

This in turn increases a company’s CT liability, however the same RDEC value is given as ‘tax voucher’, for want of a better phrase, that can be offset against the CT.

A company therefore receives 81% of the RDEC value back from HMRC (net of the 19% additional CT that it has generated).

The effective benefit is therefore 13% (RDEC rate) x 81% (net CT rate) = 10.53%

Unlike the SME scheme where a company’s benefit could vary depending on their P&L position, those who claim under RDEC will always receive 10.53% of their R&D spend. This is due to the ‘7 Steps of RDEC’ for loss making companies.

The 7 Steps explained:

Step 1: Offset RDEC against CT liability

Step 2: Calculate Withheld CT tax at CT rate – 19% of RDEC value

*This withheld amount can be group relieved or carried forward to offset future CT liabilities

Continue with ‘net RDEC’

Step 3: Limit to total PAYE/NIC of R&D staff – this isn’t restricted to their R&D apportionments

Step 4: Offset against unpaid CT liabilities of the company

Step 5: Offset against any group company CT liability

Step 6: Offset against any other outstanding tax liabilities of the company

Step 7: Cash credit to company

The entire ethos of the 7 Steps is for HMRC to ensure that no cash credit is paid out if there are outstanding tax liabilities and that HMRC do not end up paying out more than they have received on a R&D project (PAYE/NIC payments).

For most loss making company’s, they reach Step 7 with no issues. The only concern a company should have is if the bulk of their R&D has been carried out by Externally Provided Workers, however a company can include the PAYE & NIC amounts if a connected EPW and these have been paid by a connected company.

If the above is still making you scratch your head, don’t worry as that’s why we’re help.