R&D Update (June 2023)

What's new in the world

of R&D Tax

Over 20 plus years the two (soon to be one) R&D Tax schemes have seen a lot of changes. However, there has not been more of a spot light on the regimes than the past few years with:

- Additional information and claim notification forms,

- Tribunal cases (Hadee and Quinn) focused on HMRC’s interpretation of subsidised and subcontracted R&D with more expected later this year,

- The House of Lords committee sessions last November,

- HMRC increasing its compliance workforce to over 200,

- Consultations into the shaping of the scheme(s) in the future,

- Changes to modernise the scheme eg data/cloud costs and mathematics (see below),

- Targeting fraud and abuse of the scheme, that was cited by Jeremy Hunt in the last budget as a driver for reducing the SME net benefit.

The below summarises the known key changes and developments as of June 2023. Consultations and legislation is still ongoing for some so it is important to seek professional advice before utilising any of the information.

Changes from 1 April 2023

During the 2023 Spring Budget, changes to the R&D rates were announced that would take immediate effect from 1 April 2023. Previous rate changes seemed to allow a blended rate to be used for accounting periods straddling dates with changing rates, however a recent R&D Communication Forum suggested that costs should be allocated in the period they were incurred for fear of “manipulation”.

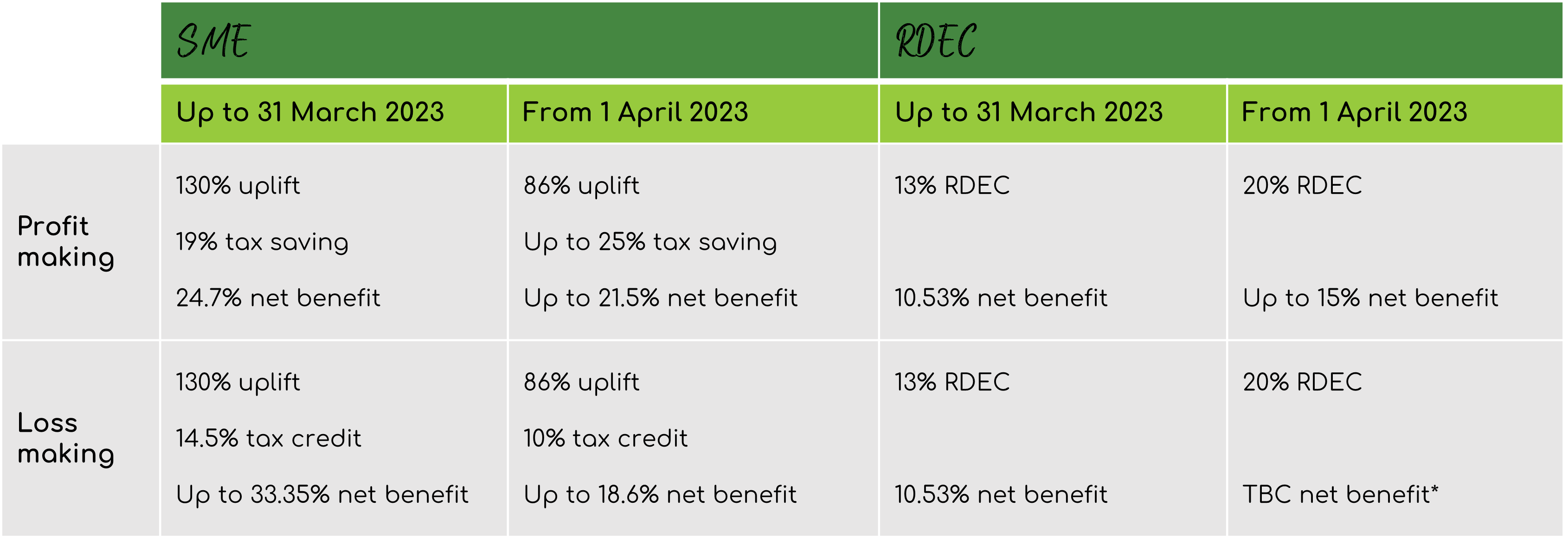

From 1 April 2023 the revised rates are as follows:

*with the return to two CT rates from 1 April 2023, we are still awaiting confirmation of which rate would be used in calculating ‘net RDEC’ for loss making companies.

It was also announced that the 14.5% tax credit for loss making SMEs would remain (instead of the new 10% rate) for companies spending 40% of their expenditure – providing a 27% net benefit. From the Budget supplementary information we learnt that whilst the higher credit starts from 1 April 2023 (following legislation being passed) and applied to expenditure from this date, accounting periods straddling this date will still need to meet the 40% requirement for the entire period. This means that a company with a June 2023 year end will need to have R&D expenditure between April-June 2023 that meets 40% of their total annual expenditure. With a proposed merged scheme (see below) in discussion from April 2024 it is unlikely that many companies will meet the criteria for the effective 26.97% benefit.

Changes affecting accounting periods from 1 April 2023

Overseas expenditure - delayed

Whilst it was originally intended to come into force for accounting periods starting on or after 1 April 2023, the restriction on overseas workers has been postponed a year to come into force for accounting periods start on or after 1 April 2024.

With the focus of incentivising UK based R&D, the restriction will prevent companies from being able to claim overseas based EPWs and subcontractors. The only exceptions where it wouldn’t be “wholly reasonable” to conduct the R&D within the UK due to geographical or regulatory restrictions. It being more cost effective to outsource the work overseas will not be an accepted exception.

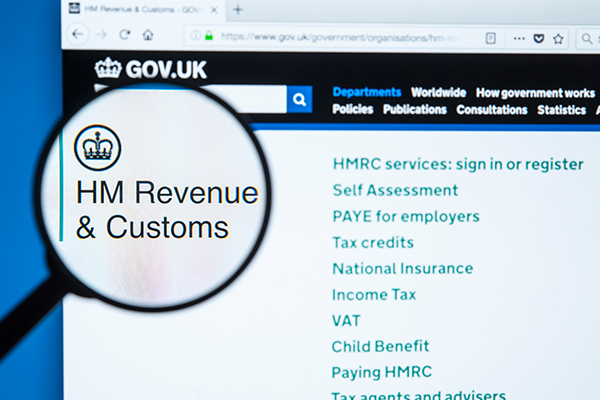

Additional Information Form

From 1 August 2023 all companies, regardless of their year-end, must submit an Additional Information form through HMRC’s online portal. Failure to do so will invalidate the claim. Whilst it has not been a legislative requirement to submit a claim report, although HMRC have always had the powers to request information to substantiate any claim, it has always been best practice to provide one.

For those who have always submitted a report, most of the information would already be gathered during the claim preparation process, whilst others are straight forward to provide eg the company’s VAT, SIC and UTR numbers. The representative of the company as well as the R&D advisor (if one was used) must also be included.

Whilst project information across certain headings (baseline, advance, uncertainty etc) should already be provided HMRC now require a certain amount of projects to be written up based on each project’s Qualifying Expenditure (QE):

- Claiming 1-3 projects – cover 100% of the total QE (all projects described).

- Claiming 4-10 projects – cover 50% of the total QE with a minimum 3 projects described.

- Claiming 10+ projects – cover 50% of the total QE with a minimum 3 projects described, if the QE is spread across multiple smaller projects then describe the 10 largest projects.

Beyond the administrative burden of completing the form, these changes will require companies to apportion all costs on a project by project basis. Whilst timesheets and tracking project specific external costs are preferred, HMRC haven’t been as strict in insisting percentages/costs are provided per project. This has allowed holistic percentages for staff who may have worked across multiple projects to be applied – even if splitting the holistic percentage across multiple projects would generate the same QE for that individual.

For company’s claiming only a handful of projects the project description changes wouldn’t have much impact, however for those would complete hundreds of projects a year and may only write up 3-5 projects as a representative sample will now need to provide a lot more information moving forward.

Consultation into a single scheme

HMRC has recently consulted on the consolidation of the SME and RDEC schemes into a single scheme more in line with how RDEC operates. It is their intention that this change will come into force from 1 April 2024 but this may be delayed. The consultation also provides insight into a focus on subcontracting R&D, utilising a PAYE/NIC cap, more support for R&D intensive companies and the impact of such changes on businesses. We are awaiting the findings and outcome of this consultation.

Ask our expert: Adam Spriggs

Got a specific question?

Why not book a one-to-one chat with our R&D Tax Director, Adam.

In April HMRC released a range of new and updated guidance. Some of which have been covered in more detail above, but some of the more noteworthy changes included:

“Rarely eligible” sectors

HMRC has recently updated more of its guidance to more accurately reflect it’s interpretation of various aspects of the R&D Tax schemes. In what is one of the first incidents of HMRC targeting abuse of the schemes, they HMRC have listed sectors which are “rarely eligible” for the relief and includes:

- Care homes

- Childcare providers

- Personal trainers

- Wholesalers and retailers

- Pubs

- Restaurants

They have also stated that it is “very unlikely” that a project would be eligible if it has already been conducted, or concurrently being conducted elsewhere.

Bonuses

CTA2009 s1123 covers “Staffing costs” and from this it has been known that all payments of money, by way of their employment would make up an employees ‘cost to the business’. This would exclude benefits in kind and dividends, but would include salary, employer’s NIC and pension contributions as well as bonuses, so it was thought. Revised guidance now states that you cannot claim for bonuses, redundancy payments (per Nichols v Gibson) and clerical or maintenance work that would have been done anyway.

This has yet to be challenged, however bonuses seem to meet the requirements set out in CTA s1124 as CIRD83200 points towards when covering the eligibility of one-off payments. Any inclusion of bonuses in calculating staffing costs should be done so with this in mind.

Following sessions in November 2022, the House of Lords published their report into the draft clauses in the Finance Bill 2022-23 on reforms to R&D Tax Relief and provided 26 recommendations. Amongst these, some overarching themes included:

- Updating the CIRD, BEIS Guidelines and promoting more awareness of the schemes.

- Companies providing more information, naming an advisor, endorsing the claim by a senior officer of the company and having to notify HMRC of an intention to claim will not be effective in isolation to combat abuse of the scheme. It was suggested that improvements to HMRC’s compliance capabilities are also needed.

- The claim notification requirement is onerous and risked companies being unable to make legitimate claims. It proposed this being dropped from the Finance Bill.

- Felt that HMRC needed to increase awareness of the scheme and improve its guidance stating “It is not appropriate that a document intended to explain innovation has not been revised since 2010”.

- Concern of re-focusing the relief to activity undertaken in the UK may undermine the UK’s competitiveness and causing some companies to relocate elsewhere.

- Concern of the uncertainty around subsidised R&D following the Quinn case.

HMRC subsequently published a response where they accepted or partially accepted the majority of the recommendations (mainly around updating guidance, providing more examples, general training and education of both HMRC personnel and companies), however they did not accept 4 recommendations, being:

- They will not drop the claim notification requirement as felt it’s needed in response to high levels of error and fraud and will limit the ability of spurious claimants to submit bulk claims.

- They felt that there is no uncertainty around subsidised R&D as HMRCs view has remained consistent and directed customers to the CIRD for their view.

- They will not publish the findings of the RDEC Advance Assurance pilot program due to the insufficient evidence obtained from the small scale of it.

- They will not provide a warning that any payments made may be recovered later pending an enquiry primarily due to the resource and IT costs of doing so and cited the lack of evidence that this would be beneficial.

HMRC also stated responded that the delay of the implementation of the overseas workers legislation will enable HMRC to consider how this will interact with the design of the potential single scheme.

If you would like to discuss how we may be able to help you handle your R&D enquiry then please contact us to arrange an initial consultation

Book a call