Could you be missing out on tax relief? Unlock the unclaimed tax savings in your short-term let, before it's too late!

Many short-term let owners . . .

. . . believe that they have claimed all their capital allowances and are totally unaware of this extra level of tax relief available to them on embedded ‘fixtures’ in the fabric of their property. This includes heating and electric systems, kitchens, bathrooms and more.

This tax relief can be claimed on part of the original purchase price or construction cost of the building, and can generate significant tax savings. You could also be entitled to reclaim tax paid as a cash rebate. Capital allowances can also be claimed on the embedded fixtures that are installed during refurbishment and conversion costs. There is no time limit to claim, as long as you still own the property.

With the change in rules approaching, now is the time to review your capital allowances and ensure you have not missed a claim.

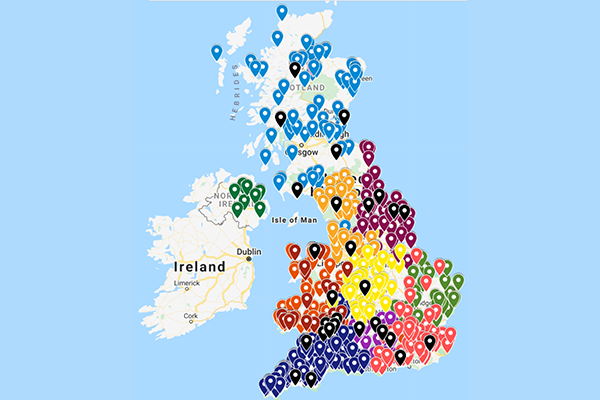

Zeal are working with Pass The Keys to ensure all short-term let owners take advantage of this tax relief, before it’s too late.

Further Information . . .

Zeal – The experts in Short-Term Let taxation.

With unrivalled industry knowledge and expertise in short-term let taxes and capital allowances, Zeal are the go-to tax experts in the sector, and are the trusted partner of key industry leaders including Pass The Keys, PASC UK, Sykes Holiday Cottages and The Holiday Cottage Handbook (to name just a few).

As Chartered Tax Advisors and Capital Allowances Surveyors, Zeal specialise in helping short-term let owners uncover the unclaimed tax savings in their properties and can help you navigate the intricacies of capital allowances tax relief.

Our experts will guide you through the process of identifying missed tax savings through unclaimed capital allowances, and ensure you get the full benefit of what’s available to you, before the FHL tax rules change. This could mean significant financial advantages for your holiday let business.

To help ensure short-term let and serviced accommodation owners take advantage of the tax relief available to them before it’s too late, Zeal are offering a free review to help you identify if you have unclaimed capital allowances in your property.

To get started, contact Zeal!

01633 499491

[email protected]

Watch our short explainer video - it sums everything up perfectly!

Reclaim thousands in tax relief from HMRC!

We can help you reduce or even eliminate your next tax bill and unlock thousands in future tax savings. Many of our clients also receive a cash tax rebate from HMRC.

Our in-house specialists do all the work for you!

We lead the way from the first discussion, through the whole process until you

receive your tax savings from HMRC. We need very little of your time, or your accountants, and complete claims in a few weeks.

There’s no cost to uncover how much you're entitled to!

We offer a risk-free service with no upfront fees and carry out a building survey to uncover every qualifying fixture, all at no cost to you. You only pay our fee if your claim is successful.

You might also be interested in . . .