West Wales Holiday Cottages Are there unclaimed tax savings locked in your holiday property?

As a holiday cottage owner . . .

. . . you could be entitled to claim a specialist UK tax relief on a part of the cost you spent to buy, build or refurbish your property. This is for ’embedded fixtures’ found in and under your building including electrical and heating systems, water pipework and much more.

If you meet the Government qualifying criteria, a claim on these fixtures could unlock substantial tax savings for you. In most cases, we find 20%-30% of the cost incurred as qualifying for tax relief. On average this amounts to £25,000 in tax savings per property!

Zeal are experts in Holiday Let taxation, specialising in helping owners unlock thousands of pounds in unclaimed tax savings which they had no idea they were missing out on.

Tax can be confusing and a minefield for both new and experienced serviced accommodation owners. As specialist tax advisors, Zeal can advise on a range of tax matters including Capital Allowances, VAT, Stamp Duty Land Tax, Capital Gains Tax, Tax Efficiency & Planning, and more.

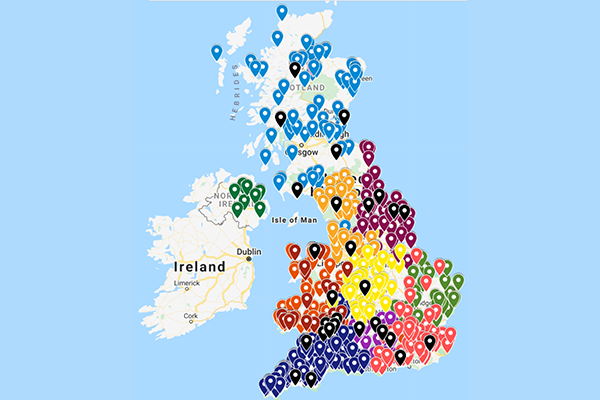

Zeal are working with other industry leading organisations from all over the UK to provide support and guidance to short term let owners, especially in light of the Spring Budget 2024 announcement, ensuring they make the most of available tax incentives before it’s too late.

Just some of our partners include Sykes Holiday Cottages, the Professional Association of Self-Caterers (PASC) and the Association of Scottish Self-Caterers (ASSC).

Reclaim thousands in tax relief from HMRC!

We can help you reduce or even eliminate your next tax bill and unlock thousands in future tax savings. Many of our clients also receive a cash tax rebate from HMRC.

Our in-house specialists do all the work for you!

We lead the way from the first discussion, through the whole process until you

receive your tax savings from HMRC. We need very little of your time, or your accountants, and complete claims in a few weeks.

There’s no cost to uncover how much you're entitled to!

We offer a risk-free service with no upfront fees and carry out a building survey to uncover every qualifying fixture, all at no cost to you. You only pay our fee if your claim is successful.

Watch our short explainer video - it sums everything up perfectly!

You might also be interested in . . .